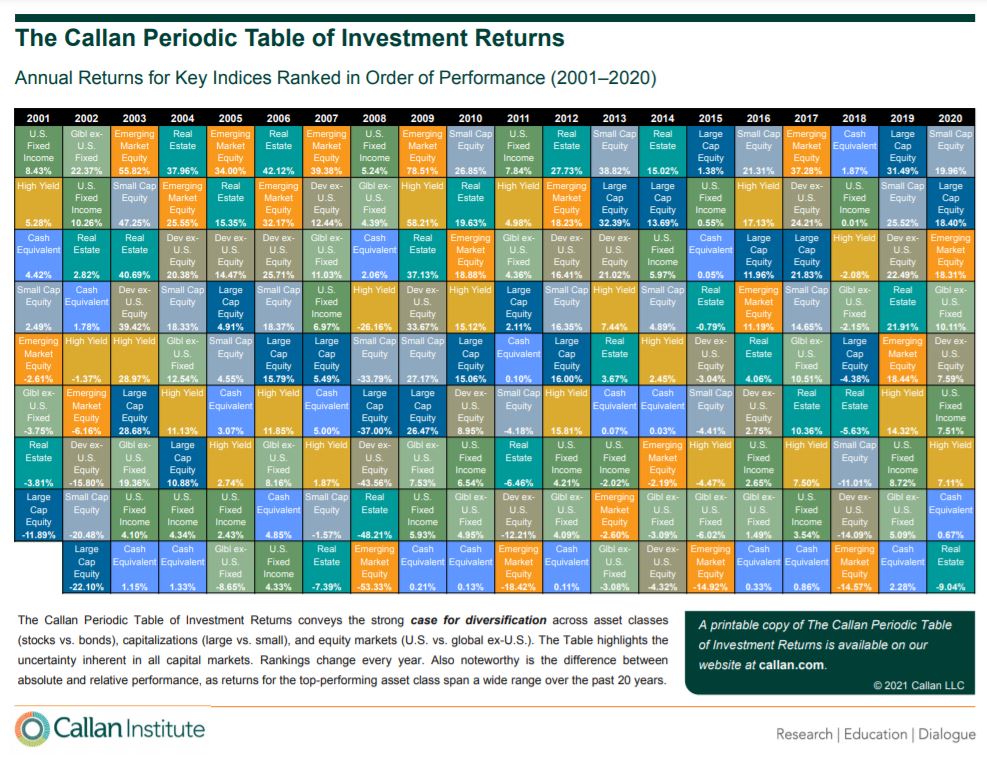

Avoid Chasing Performance

As is clear from inspection of the Callen Periodic Table of Investment Returns (see image to right), asset classes that are “hot” and booming this year can often be the busts of next year. Many investors end up frustrated and disappointed by chasing the hot asset class of the moment, often ending up being late to the party and getting in just before the selling begins.

In recent decades we have seen investors chase internet stocks in the late nineties, then BRIC (Brazil, Russia, India and China) stocks and real estate in the naughties, and Crypto and NFTs during the Covid Pandemic.

Consider that when everyone is bragging about their returns in a certain asset class, who are the incremental buyers left for that asset class that will push prices higher? At that point there are far more potential sellers than buyers.

We offer no guarantee that applying our strategies will in fact achieve lower beta performance or provide any particular return, positive or negative. Past performance is no indicator of future return.