Process

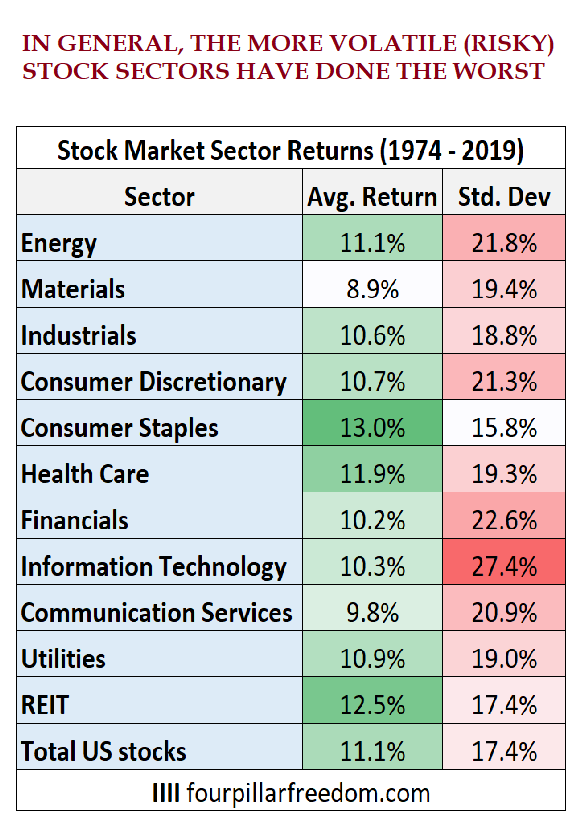

Fair Weather Strategies rejects the widely held concept that more volatile stocks and sectors will necessarily provide higher return. History has shown that at least in the United States, over the long term, higher “beta” stocks (i.e. stocks with that are more highly geared to market ups and downs) have under-performed less flashy, steadier stocks.

We seek out these steadier stocks in building our portfolios.

Investing, as applied to our actively managed portfolios, aims to keep the investor holding a security only as long as it maintains an upward price trend. When the security is no longer able to maintain upward momentum, the security is sold and the proceeds moved to a cash or cash equivalent holding until such time as momentum returns.

We offer no guarantee that applying our strategies will in fact achieve lower volatility or provide any particular return, positive or negative. Past performance is no indicator of future return.

Research

A number of influential whitepapers have been written documenting where researchers have grouped stocks into quartiles or deciles based on the past volatility of the individual stocks. The researchers then tracked the performance of these groups of stock over subsequent periods of time (usually twelve months).

Using this methodology, the researchers were able to highlight a strong negative correlation between past volatility and future risk-adjusted return, with the least volatile groups of stocks having stronger risk-adjusted returns in subsequent periods. In other words, investors were not getting additional returns from the riskier stocks sufficient to compensate them for the stress of the additional volatility that came with holding these “lottery-type” stocks.

Whitepaper examples:

Is the Low-Volatility Anomaly Universal – S&P Global. Fei Mei Chan, Craig Lazzara