Process

Fair Weather Strategies is focused on long term investing. In fact, we would rather than clients not request that we manage money for them that may be needed to within the next five years. We would rather those funds are kept in stable money market funds or CDs or very short-term bonds outside of the supervision of our firm.

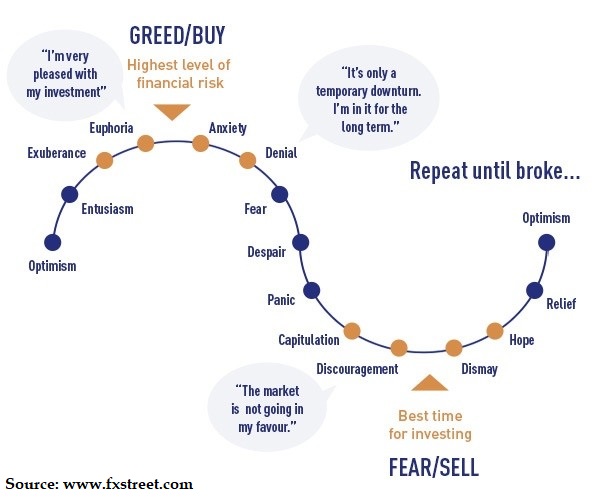

We believe that when clients are secure in knowing that they have cash available and ready for their emergencies and near term (0-5 year goals), they are much more resilient to the ups and downs of the market and their long term portfolios. In our experience, clients are less likely to choose to sell investments at market bottoms when they know they money is not needed for many years in the future and that there is ample time for the market and their portfolios to recover.

We therefore like to work closely with our clients to match their future liabilities (college tuition spend, retirement spending, estate needs etc.) with portfolios that have time horizons that match those particular needs. Money needed in the next 5 to 10 years will be invested in lower risk and return profile portfolios than money needed for goals say 20 plus years from now. Such asset and liability matching is an integral part of our process.

Research

Past performance is no indicator of future return.

Dalbar’s annual study seeks to quantify how much the average equity and fixed income investor has lagged the relative benchmarks by trying to time the market.

For example, their 2016 study found that common investor behaviors such as selling stocks after an equity market downturn — have caused average investor results to significantly lag the broader markets over a 20-year plus timespan.